Lemmi was born to give everyone the power to write their own story.

We’re doing everything we can to ‘democratise’ the business of wealth creation. That means making it easier to access, understand and enjoy (why should it just be wealthy people who get this?). We’re unlocking the methodology and secrets that have been behind closed doors for years. We want you to have the confidence to get involved and make it happen.

LEMMI WHO?

Our story goes back over thirty years, to the formation of New Zealand Financial Planning, a group of leading Kiwi based wealth advisers who broke away from their Australian employer to offer a better service to their clients. Since that start, we’ve had a strong track record, constantly growing and preserving our clients’ wealth and financial wellbeing through the good times and bad.

And now through Lemmi, we’re making our knowledge, support and coaching open to everyone.

The Peace of Mind bit

We're licenced as a financial advice provider by the Financial Markets Authority, which means that we are obliged to operate to a set of high standards. We don’t just aim to tick the boxes though, wherever possible, we strive to exceed the minimum regulatory requirements. Read our Financial Advice Provider Disclosure.

We’ve always been proactive when it comes to good client outcomes and developed our own charter to ensure we treated clients fairly, years before the FMA brought in the Code of Conduct for Financial Advisers in New Zealand. A member of our team helped set this conduct code now used by all financial advisers in the country.

The units in your portfolio are only ever in your name and Public Trust holds the assets in custody on your behalf - your portfolio ownership is distinct and independent from Lemmi.

Any cash you put in or take out of your portfolio is transacted through an independent trust bank account, managed by the Public Trust. This keeps these transactions at arm’s length from Lemmi, as further protection against fraud or misappropriation.

Lemmi’s investment arm, New Zealand Investment Portfolio Management, is also licensed under the Financial Markets Conduct Act 2013 as a manager of registered schemes.

As you can see, we’re from a good family.

The Lemmi Approach

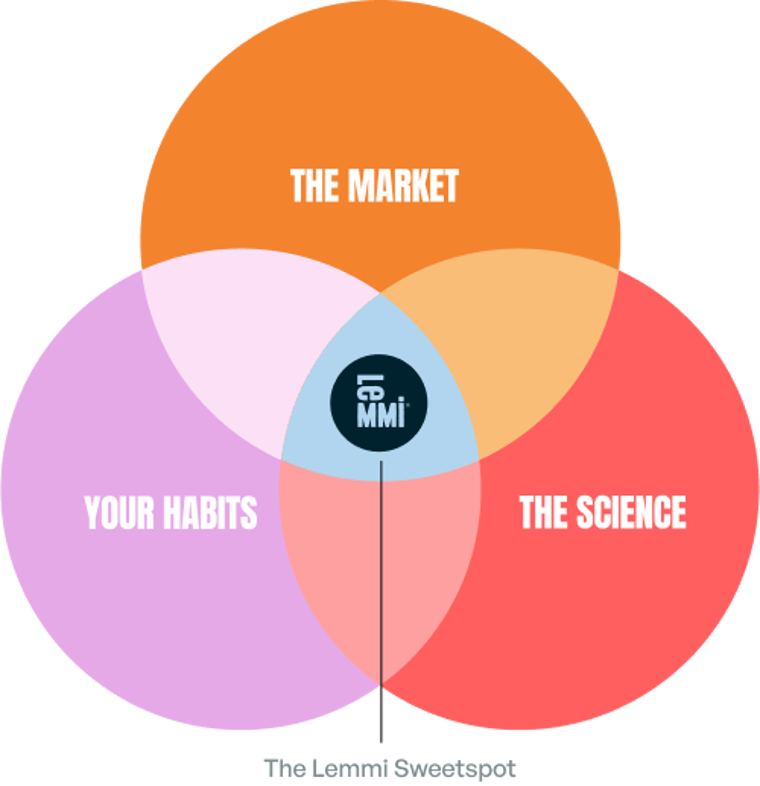

Our aim is to help you reach your financial goals with confidence. Instead of measuring success solely by benchmark returns or comparing ourselves to other funds, we focus on your likelihood of achieving your specific objectives. Your investment success is driven by three key factors:

-

The market - where we are investing for you

-

The science - how we manage your risk and return exposures

-

Your habits - how you react and the decisions you make, in both favourable and challenging times.

Your personalised Lemmi goal plan carefully and scientifically balances each of these factors to find your Lemmi sweet spot.

Lemmi Science

We're not risk avoiders; we're risk managers. Your savings are constantly being eroded by inflation so your Lemmi goal plan will include sufficient investments in riskier or growth assets like shares, which outperform just holding cash in the long run. We manage this risk methodically, with structured research and proper diversification. By avoiding over or unintended exposures to single risks, companies, or sectors, we enhance the quality and consistency of returns while minimising the size of any declines (remember it is normal that shares go up and down in value from time to time).

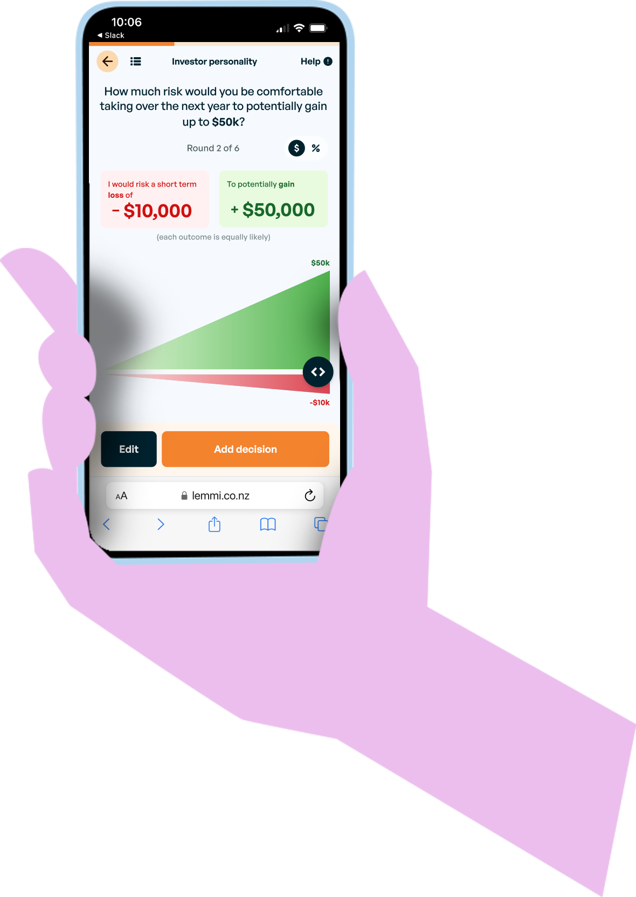

To suit your needs and keep you on track, your investments must align with your risk profile.

Whether your investment horizon is 3 or 30 years, we acknowledge that what the future holds is uncertain. Rather than attempting to predict it as some investors attempt to do, we instead focus on proper risk management, diversification, and a well-implemented investment process.

We consistently research and review all investments and indicators to ensure they align with their intended risk/return roles within your portfolio. We aim to smooth returns where possible to better ensure your money is available when you need it.

Our Lemmi service is focused on helping you make decisions that keep you on track to achieve your goals through a combination of general advice and timely, focused, tips.

Our Team

The Lemmi team is made up of highly experienced wealth management and investment professionals. The team are passionately united by our purpose of unlocking the wealth industry for all New Zealanders.

Mary Buckley (1), The Behavioural Scientist

Craig Dealey (2), The Evangelist

Bruce Campbell (3), The Dreamer

Shelley Dick (4), The Advice Guru

Marilyn Boyd (5), The Money Minder

Rich McCormick (6), The Police Officer

Alyse Baddeley (7), The Connector

Mark Wooster (8), The Investing Guru

Our core values of Focus, Community, Humanity and Fluidity are at the heart of what guides how we work together. We prioritise client outcomes, foster collaboration, lead with compassion and conviction, and embrace agility and innovation.

Our Process

The process of joining Lemmi will take up to 4 or 5 business days – we need to ensure we have the information to keep your money safe and sound.

The initial process is fairly quick, you will be asked about your goal and answer some short questions so we can build your personalised Lemmi goal plan. After you are happy with the plan, we then open your account and complete all the required formalities to ensure your account remains secure. Once your account is opened (this can take 1-2 business days) we will advise you how to deposit your money into your account. Once received, we will create your investment according to the agreed plan. This part of the process can take another business day or two. Once your investment is created, the Lemmi App is where you can monitor progress against your plan, make changes to your account, arrange deposits and withdrawals, etc.

Through the process we will be helping answer your questions – possibly even before you think of them! Ongoing communication, tips, acknowledgements and insights will help keep you informed, on track and motivated to get to your goal.

As part of the Lemmi service, we will regularly review your investments and rebalance the split between the different risk levels to ensure you Lemmi investment stays in your investor sweetspot.

Our Lemmi Team service offers ongoing access to our Financial Advisers – perfect for that moment when a new opportunity pops up, or you simply need a little reassurance from time to time.