Whether you’re a first-time job-er or a career veteran, it’s not always clear just how much to put aside in KiwiSaver. So, let’s break it down and chat about KiwiSaver contributions making it a mystery no more!

If you’re a joyful-saving-squirrel and you find it easy to stash nuts for the winter, you will be thinking about KiwiSaver a little bit differently to the carefree-spender. Since it’s easier for you to save, you could look at the minimum-in for maximum-out strategy.

The minimum-in for max-out strategy says you should put the minimum percentage (usually 3% of work income) to match whatever the highest your employer is willing to contribute (also usually 3%). You can then put the extra you would’ve put into your KiwiSaver into an investment portfolio (like Lemmi!) that you can access even if you aren’t buying a house or reached 65 yet! It could be that you want to invest toward a big OE down the track or fund university education for the little ones. No matter the goal, an investment alongside KiwiSaver can be great for achieving life’s little challenges alongside the bigger stuff like buying a home or reaching the point of complete financial independence!

If you’re more of a carefree-spender, you may be suited best to the lock-it-away strategy.

The lock-it-away strategy is where you say, “you know what, I don’t want to look at it or think about it, I just want to contribute an amount that makes sense for retirement, and I’ll sort out the other medium-term stuff separately.”

In this strategy, KiwiSaver could be your main tool toward financial freedom, and you’ll be targeting age 65 as your date of financial freedom. You’ll select a higher rate of contribution (if you’re a little closer to 65 – this could be the 10% option) and if that amount of saving wouldn’t get you there, you could use a Lemmi portfolio for additional savings to help you close the gap over and above the 10% contribution. If that’s the case, don’t worry! We’re here with you and got your back to help you get to where you want to go.

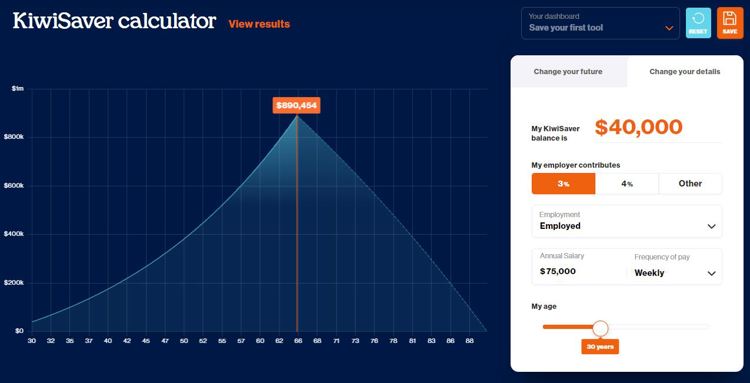

To figure out exactly where you’re at, take a look at these awesome calculators from Sorted. The KiwiSaver calculator can show you how much your KiwiSaver could grow to.

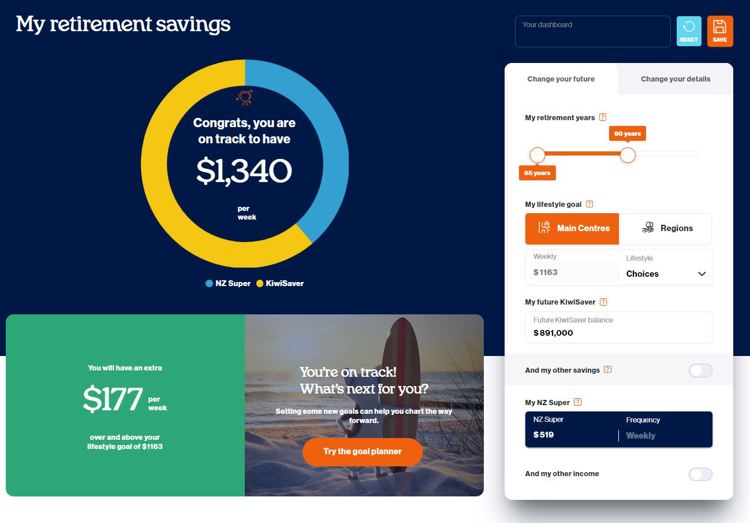

The Retirement Savings Calculator below can show you how much savings you could need to live your desired lifestyle.